Table of Contents

Getting foreign currency is a crucial piece of travel experience. In a foreign country, no access to local currency can be a scary experience.

Hence, we will learn how to get Vietnamese Dong (VND):

- at right rates

- in the legal way

- in your own country (get VND in India)

- in foreign country (get VND in Vietnam)

- in the right amount

But why use cash in Vietnam and not credit or debit cards?

Vietnam is still predominantly a cash-first country. Using only credit and debit cards will limit the places you can visit, like street food places or even getting a Grab bike

INR to Vietnam currency

INRVND currency converter with forex market rate:

Try to buy Vietnamese Dong (VND) closest to the forex rate. This is where it gets tricky. You need to get the right foreign currency at the right place to get the right price.

Buy Vietnam currency in India

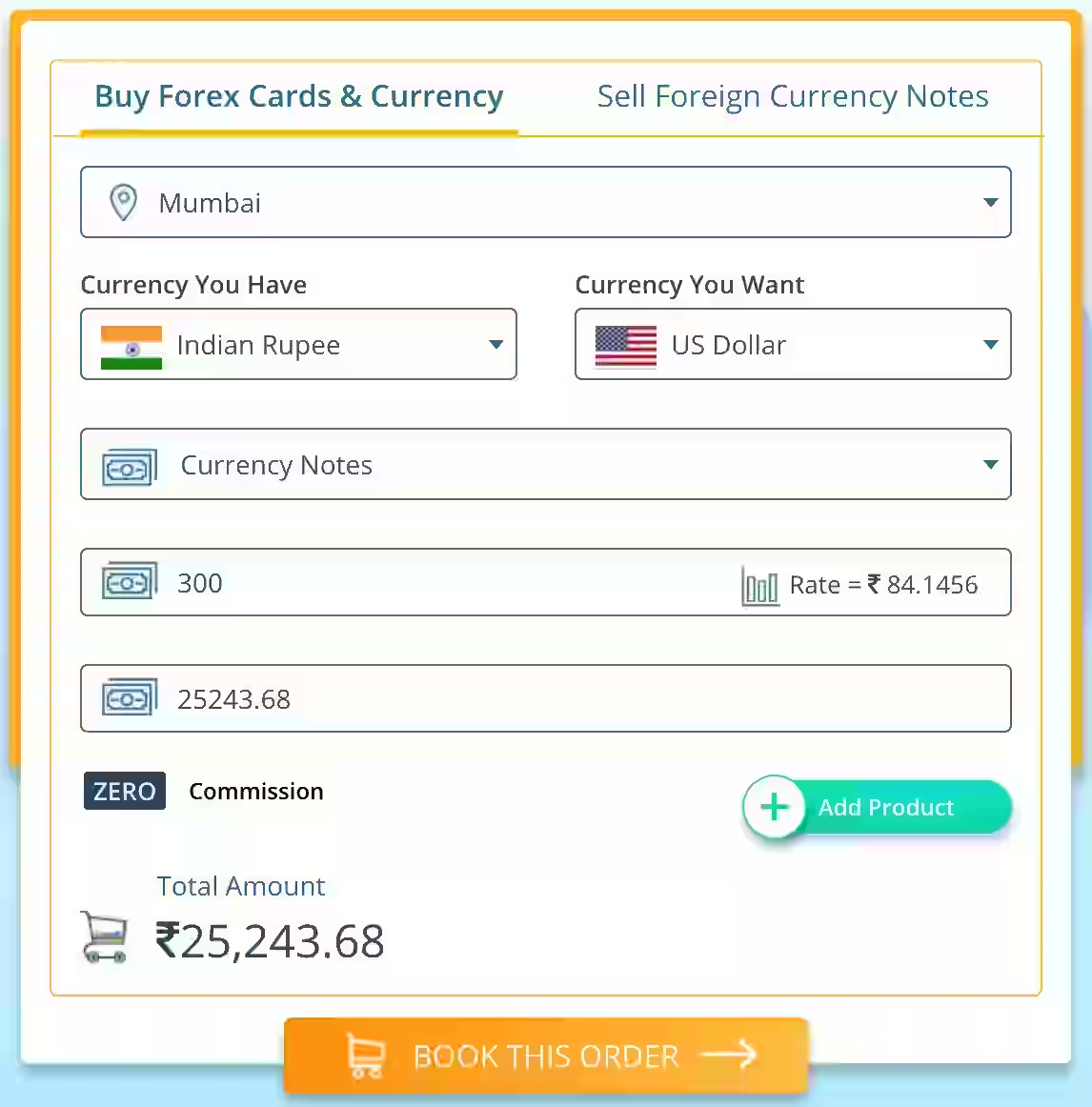

INRVND currency converter with BookMyForex rate:

The dumb way: You can buy VND in India from an authorised forex dealer like BookMyforex. But it can be seen that rate offered by BookMyForex is not great compared to the offering in the forex market.

Why is buying VND so expensive in India?

Vietnamese currency VND is an exotic currency, meaning the currency does not have sufficient demand in the global market. Less buyer and sellers of the currency makes the buying and selling cost very high.

Buy USD in India

The smart way: Wait? but why? I am travelling to Vietnam, not the US, why should I buy USD. Well, that's cause USD has the highest global demand hence the buy/sell rate are great even in India.

Can I buy USD currency notes from BookMyForex whenever I want?

No. You can only buy USD currency notes from an authorized forex dealer like BookMyForex when you have a valid visa, like Vietnam's e-visa and air tickets for the travel destination.

Are online forex brokers like BookMyForex always giving better rates than brick-and-mortar ones?

I asked a local forex broker in Mumbai for USD currency notes. It turned out that both the local forex dealer and BookMyForex are offering USD currency notes at the same rate. So please don't go with the perception that online brokers offer a better rate. First, compare whose offering better rates.

USDINR currency converter with BookMyForex rate:

USDINR currency converter with forex market rate:

The difference between rates offered between BookMyForex and the forex market is minimal. You can carry the USD purchased in India to Vietnam and buy VND from it at the airport. The USD is even accepted directly at many places in Vietnam, specially tourist hubs like Da Nang.

What if I didn't spend all the USD I purchased for my Vietnam travel?

As an Indian citizen, you can keep $2,000 physical currency notes. Since USD is a globally accepted currency, you can use it for your next international travel to any other country.

USDINR currency converter with forex market rate:

How much foreign currency can I carry from India?

You can carry up to $3,000 foreign currency notes from India. If you need more foreign currency, then you can carry credit and debit cards.

USDINR currency converter with forex market rate:

Withdraw VND from Vietnam ATM

The smartest way: Get a zero forex markup debit card and use it to withdraw VND from a zero forex markup ATM. This not only give you great conversion rates, but you can also skip the hassle of buying any currency notes before your actual trip. It also allows you skip the hassle of buying USD currency notes just for great conversion rates.

So, if you have zero forex markup debit card, you don't need to carry USD currency notes?

How to find zero forex markup ATMs for cash withdrawal in Vietnam?

You can search for Ocean Bank or MB Bank. Both ATMs accept international Visa and MasterCard debit cards and are zero forex markup ATMs.

Note: These Google map links will give you the right results only when you are in Vietnam.

Which debit cards are accepted in Vietnam ATMs for cash withdrawal?

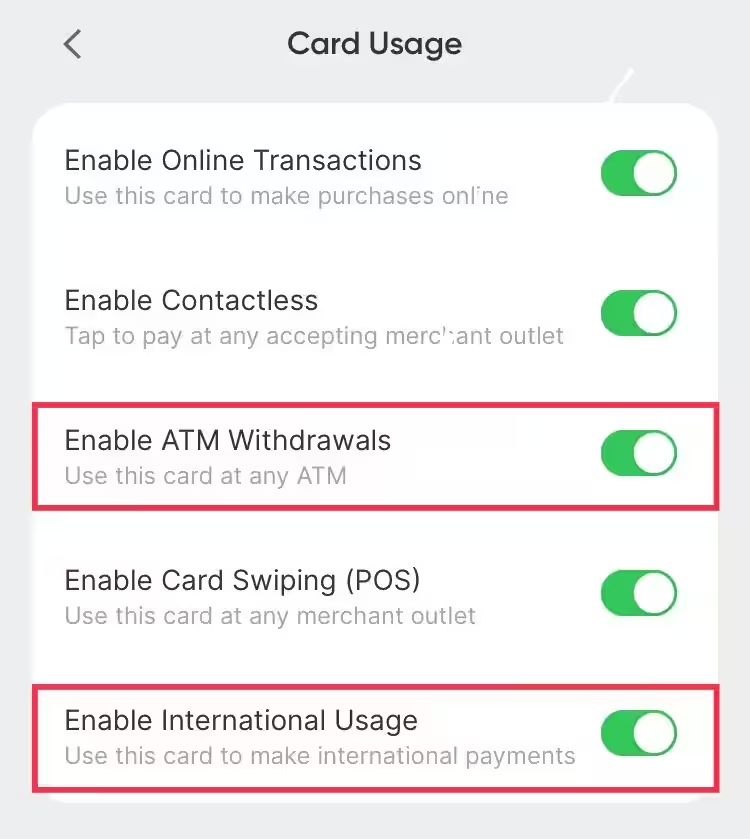

Visa and MasterCard are the widely accepted cards in Vietnam ATMs. You will have to enable ATM withdrawals and international usage. Please do not carry RuPay or Discover for cash withdrawals in Vietnam. No ATMs are likely to accept them.

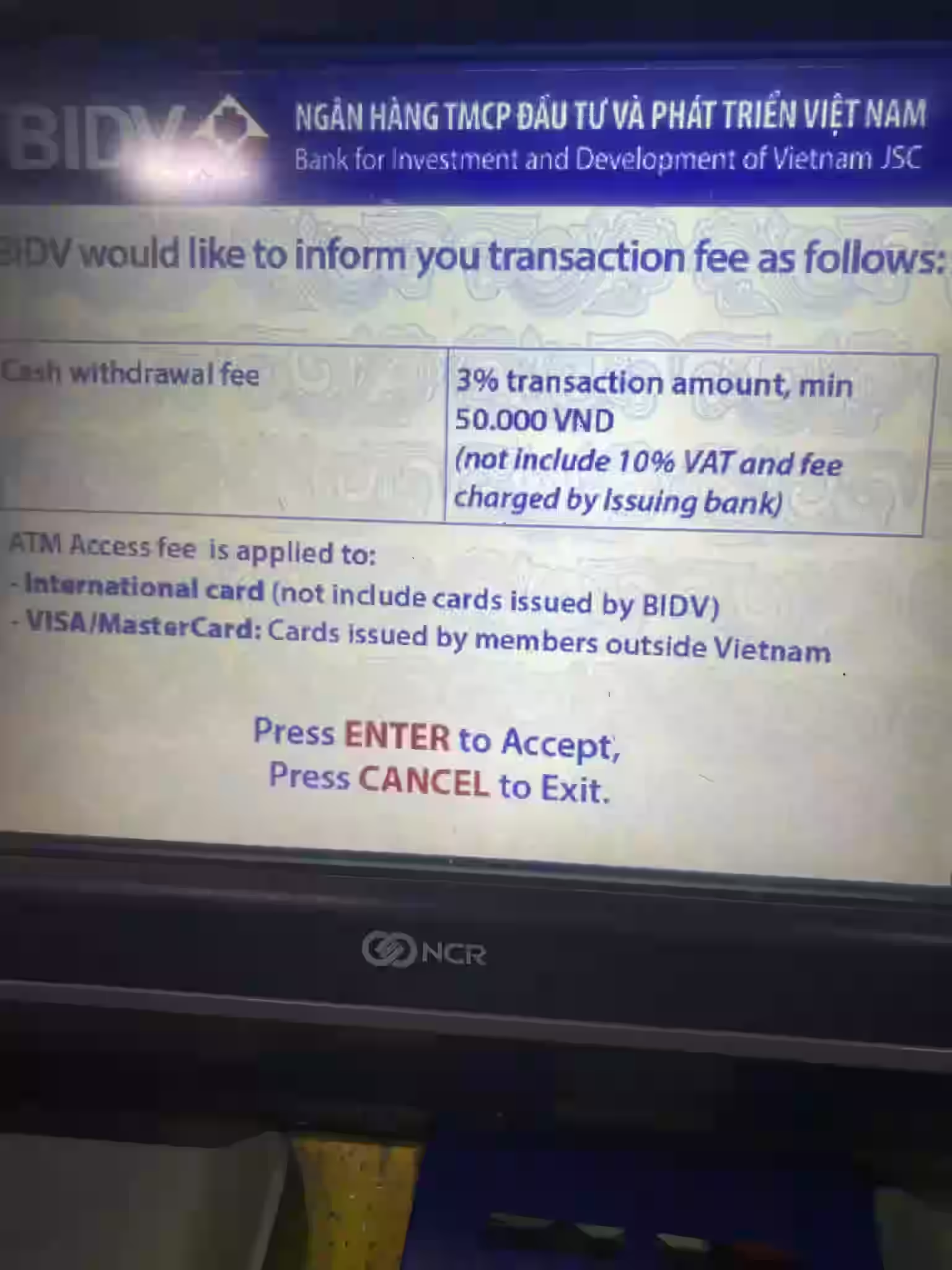

Will using any ATM for cash withdrawal cost me zero charges if I use a zero forex markup debit card?

No, Using any random ATM can cause you forex charges up to 3%. Hence, using a zero forex charge debit card isn't enough. It's essential that you also use that card in a zero-forex ATM.

What is forex card?

Forex cards provide the same benefit as zero forex markup debit cards, which are zero charges for cash withdrawals, but they come with the hassle of reloading USD on them. Zero forex markup debit cards come with dynamic conversion (INR -> USD -> VND), so there is no need to worry about loading USD every time.

Also, no forex cards, as of now, support loading Vietnam currency VND. Hence, the hassle of currency conversion and forex conversion cost is still there (USD -> VND).

Why is conversion rates for VND via Vietnam ATM's so great?

Payment networks like Visa and MasterCard use the forex market (which are very liquid - many buyers and sellers of currency) to get great conversion rates unlike local forex dealer. Also, behind the scene it's simulating the same smart conversion technique (INR -> USD -> VND).

Can you bring back the Vietnam currency to India?

Yes. You can bring back ₫15,000,000 VND of physical currency notes to India without declaring to the Vietnamese customs.

VNDINR currency converter with forex market rate:

How to exchange foreign currency to Indian rupees?

You can sell it in exchange for Indian Rupee to an authorized Forex dealer, like BookMyForex.

Vietnam currency in Indian Rupees

| Major currency notes of Vietnam |

|---|

| ₫500,000 VND |

| ₫200,000 VND |

| ₫100,000 VND |

| ₫50,000 VND |

Let us understand the physical currency notes in Vietnam and how much they value in Indian Rupees.

₫500,000 VND currency notes to INR

VNDINR currency converter with forex market rate:

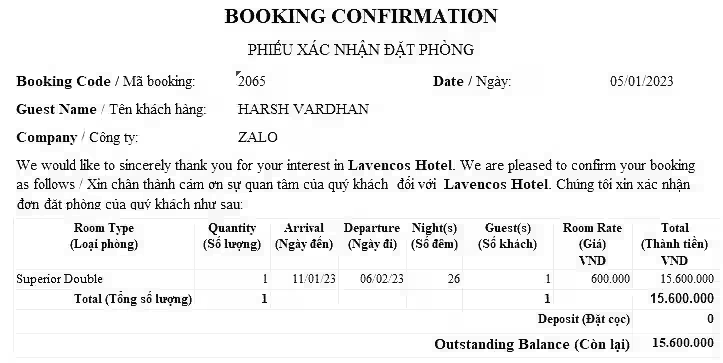

What ₫500,000 VND gets you in Vietnam

Roughly the same amount gets you a hotel room in Da Nang for a night.

₫600,000/night

₫200,000 VND currency notes to INR

VNDINR currency converter with forex market rate:

What ₫200,000 VND gets you in Vietnam

You can enjoy sushi at a nice high-end restaurant (Tram Sushi, Hanoi).

₫220,000